In 2020, due to the impact of the epidemic, the world economy suffered a severe recession, the circulation of the industrial and supply chains was disrupted, international trade and investment shrank, the commodity market was in turmoil, and domestic consumption, investment and export declined. In February, the production and sales of China’s motorcycle industry declined by more than 70% year on year, and more than half of the enterprises ceased production.

With the strong support of national policies and unified deployment, the upstream and downstream enterprises of the whole industry made joint efforts. Driven by internal and external demands, the motorcycle industry was among the first to recover from the impact of the epidemic. In 2020, the production and sales of Chinese motorcycles exceeded 17 million, down by about 1% year on year. Domestic sales reached about 10 million, down by only 0.32% compared with last year.

Production & sales

Due to the precise and effective prevention and control of the epidemic, the central and local governments issued a series of relief policies to promote the resumption of work and production. Since March, the domestic market of China’s motorcycle industry began to recover at an accelerated pace. From January to April, the sales volume was basically flat with that of the same period the year before. But in the same period, due to the outbreak in overseas markets, exports fell sharply, dragging down the overall recovery of the industry. Since the second half of the year, with the improvement of overseas markets, the industry began to recover comprehensively. During the peak season, about 3.4 million motorcycles were sold, an increase of 10.29% year-on-year, which accelerated the progress of industry recovery.

In 2020, according to the statistics of China Chamber of Commerce for Motorcycle, 93 backbone enterprises produced and sold 17,023,500 and 17,066,700 motorcycles respectively, down 1.98% and 0.38% year on year.

The large displacement recreational motorcycle market has seen rapid development since 2013. After 8 years, consumer groups gradually scaled up, which has driven the development of the peripheral industries, such as motorcycle touring, clothing & gear, and modification parts.

In 2020, the production and sales of motorcycles above 250cc was about 208,800 units, with a year-on-year increase of 13.32% and a 14-fold increase compared with that of 2013 (13,000 units).

From the perspective of total motorcycles in Chinese market, large-displacement motorcycles only accounts for about 3%, indicating a huge growth potential. With the continuous increase of residents’ income and the expansion of middle and highe income groups, it is expected that large-displacement motorcycles will account for 10% of the total motorcycle market in China in the future. In 2020, the production and sales of small and medium displacement two-wheeled motorcycles (displacement≤250cc) in China was about 12.3474 million, down 5.87% year on year; domestic sales reached 5.7542 million units, down 10.51% year on year. Electric motorcycles are mainly sold in the domestic market, with a small amount of exports. In 2020, the sales of electric motorcycles reached 2,295,400 units, with a year-on-year growth of 20.91%.

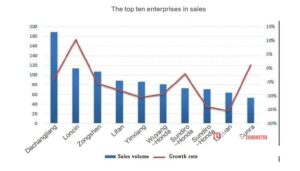

In 2020, among the top 10 enterprises in production and sales, 2 enterprises saw increase and 8 saw decrease; 8 of the top 20 enterprises saw year-on-year growth, while 12 saw a decline. The decline was mainly due to the epidemic. The competition in the domestic and overseas markets of small and medium displacement motorcycles becomes more intense.

In 2020, the top 10 enterprises in sales were Dachangjiang, Zongshen, Loncin, Lifan, Yinxiang, Wuyang-Honda, Dayang, Sundiro-Honda, Luyuan, Sunra, which respectively sold 1.8873 million, 1.1426 million, 1.0742 million, 882,200, 861,600, 810,800, 727,300, 706,800, 637,600, and 529,500 units.

Export

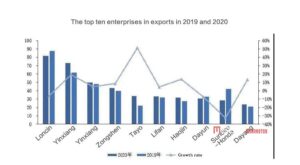

In 2020, the export of Chinese motorcycles overcame the impact of the epidemic and showed a recovery trend on the whole. The export quantity and value of complete motorcycles have increased compared with that of 2019. According to the customs data, in 2020, the export quantity of Chinese motorcycles was 9.6953 million, with a year-on-year growth of 5.86%. The top 10 export destination countries were Mexico, Myanmar, the Philippines, Togo, the United States, Nigeria, Egypt, Ghana, Peru and Iraq. The export to the top ten countries totaled 4.9562 million units, accounting for 51.12% of the total export, a slight decline of 0.71% compared with the year before. Among them, the export to the United States and Iraq increased by 105.83% and 82.87%, respectively. Nigeria and the Philippines saw decline of 34.96% and 31.36%, respectively. In 2020, China’s motorcycle export value was USD5.016 billion, with a year-on-year growth of 4.22%. The top 10 destination countries in export value were Mexico, Togo, the Philippines, Myanmar, the United States, Peru, Nigeria, Ghana, Egypt and Colombia, with a total value of USD2.205 billion, accounting for 43.96% of the total export value, a slight decline of 1.33% compared with the year before. Among them, the export to Egypt and the United States increased by 73.65% and 72.20% year-on-year, respectively. However, Nigeria and the Philippines saw significant declines of 35.19% and 32.36%, respectively. In 2020, the export quantity of motorcycles (100cc < displacement ≤125cc) reached 4.5013 million units, a year-on-year decrease of 3.87%, accounting for 42.09% of the total export; the export value of these motorcycles reached USD2.111 billion, down 2.91% year-on-year, accounting for 46.43% of the total export value. In 2020, the export quantity of motorcycle (400cc<displacement ≤500cc) reached 17,800 units, a year-on-year growth of 43.54%; the export value of these products reached USD57,342,000, a year-on-year growth of 48.67%. According to the recent survey of China Chamber of Commerce for Motorcycles, the orders of enterprises in the first quarter of 2021 are basically saturated. Although affected by various factors such as rising shipping and raw material prices, most enterprises are still optimistic about the export of this year. It is expected that China’s motorcycle export in 2021 will be basically the same as last year or with slight increase.

Economic benefits

From January to November, the total industrial output value of motorcycle manufacturers reached RMB91.178 billion, up by 4.40% year on year; the industrial sales output value reached RMB90.423 billion, up 4.05% year on year; the industrial added value reached RMB17.875 billion, up 13.47% year on year. From January to November, the production-to-sales ratio of motorcycle manufacturers was 99.17%, 0.33 percentage points lower than that of the year before and 0.26 percentage points lower than that of the first ten months.

From January to November, motorcycle manufacturers achieved operating income of RMB97.653 billion, up 2.30% year on year; the total profit reached RMB1.421 billion, down 52.43% year on year; total profits and taxes reached RMB3.461 billion, down 31.24% year on year.

From January to November, the operating cost of motorcycle manufacturers was RMB82.881 billion, with a year-on-year increase of 1.91%; taxes and surcharges amounted to RMB777 million, down 3.56% year on year; sales expenses reached RMB3.465 billion, up 0.79% year on year; management expense was RMB4.396 billion, down 3.66% year on year; R&D expense was RMB2.556 billion, up 4.50% year on year; financial expenses reached RMB2.646 billion, up 215.88% year on year. These four expenses totaled RMB13.064 billion, up 15.76% year on year. (Source: mtuocom&CCCM)