Driven by the new state standards, sharing economy and industrial upgrading, the electric two-wheeler industry is embracing explosive growth, which has also led to the rapid development of battery technology, power swapping service, motor, tire and other upstream and downstream industries.

Production and demand rocket with the market size reaching 100 billion

On April 15, 2019, the revised new state standard GB17761-2018 Safety Specifications for Electric Bicycles was introduced. Before the implementation of the new standard, more than 40% of the vehicles in the market were non-standard electric bicycles (they belong to electric mopeds and electric motorcycles), with the total number exceeding 100 million. The non-standard electric bicycles will be forcibly eliminated after April 14, 2022.

For the domestic market, the implementation of the new state standard has brought a large replacement demand, which will significantly drive the sales of electric two-wheelers. The continuous development of the sharing economy and the large-scale launch of shared electric bikes into the market also provide a strong driving force for the increase in production and sales of electric two-wheelers.

Regarding the overseas market, some regions with large population and rapid economic development use electric two-wheelers as the main means of transportation, and the market demand is as large as that in China. Influenced by China’s sharing economy, European and American countries are highly receptive to the two-wheeled vehicles launched by Chinese enterprises.

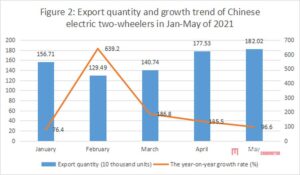

According to China’s customs statistics, from January to May 2021, China exported 7.8646 million electric two-wheelers (including scooters), with a year-on-year growth of 143.10%, and the export value totaled USD1.906 billion, a year-on-year increase of 135.96%.

Figure 3: Export of Chinese electric two-wheelers to different continents in Jan-May of 2021 (by export value)

| No. | Continents | Export volume(10 thousand units) | The year-on-year growth rate (%) | Proportion(%) | Export value(100 million USD) | The year-on-year growth rate (%) | Proportion(%) |

| 1 | Europe | 320.41 | 119.91 | 0.41 | 8.44 | 134.93 | 0.44 |

| 2 | North America | 253.30 | 277.73 | 0.21 | 4.66 | 226.65 | 0.24 |

| 3 | Asia | 167.34 | 84.81 | 0.32 | 4.51 | 83.53 | 0.24 |

| 4 | Latin America | 27.61 | 110.52 | 0.04 | 0.72 | 107.40 | 0.04 |

| 5 | Oceania | 13.36 | 166.55 | 0.02 | 0.66 | 199.59 | 0.03 |

| 6 | Africa | 4.54 | 115.47 | 0.01 | 0.08 | 111.36 | 0.00 |

Figure 4: Top 20 export destinations of Chinese electric two-wheelers in Jan-May of 2021 (by export value)

| No. | Country & region | Export volume(10 thousand units) | The year-on-year growth rate (%) | Proportion(%) | Export value(100 million USD) | The year-on-year growth rate (%) | Proportion(%) |

| 1 | USA | 232.34 | 280.22 | 29.54 | 3.83 | 235.79 | 20.08 |

| 2 | Netherlands | 53,75 | 154.69 | 6.83 | 1.86 | 170.65 | 9.77 |

| 3 | Germany | 28.13 | 53.72 | 3.58 | 1.03 | 58.37 | 5.40 |

| 4 | Republic of Korea | 21.44 | 98.25 | 2.73 | 0.99 | 165.89 | 5.20 |

| 5 | Canada | 20.86 | 252.56 | 2.65 | 0.83 | 191.78 | 4.37 |

| 6 | Russia | 38.11 | 64.34 | 4.85 | 0.81 | 115.00 | 4.24 |

| 7 | France | 33.98 | 156.01 | 4.32 | 0.74 | 153.98 | 3.86 |

| 8 | Japan | 15.96 | 31.99 | 2.03 | 0.68 | 28.71 | 3.56 |

| 9 | Poland | 34.07 | 104.18 | 4.33 | 0.66 | 137.94 | 3.48 |

| 10 | UK | 25.48 | 465.30 | 3.24 | 0.52 | 502.14 | 2.74 |

| 11 | Hongkong, China | 19.54 | 11.06 | 2.48 | 0.52 | 11.99 | 2.73 |

| 12 | Thailand | 31.36 | 780.19 | 3.99 | 0.51 | 450.05 | 2.66 |

| 13 | Australia | 10.40 | 167.58 | 1.32 | 0.47 | 187.73 | 2.44 |

| 14 | Italy | 21.83 | 132.07 | 2.78 | 0.44 | 127.30 | 2.32 |

| 15 | Spain | 13.21 | 142.06 | 1.68 | 0.36 | 172.19 | 1.89 |

| 16 | Vietnam | 9.85 | 62.69 | 1.25 | 0.30 | 87.95 | 1.59 |

| 17 | India | 9.94 | 107.52 | 1.26 | 0.25 | 101.06 | 1.32 |

| 18 | Norway | 5.57 | 113.84 | 0.71 | 0.24 | 81.90 | 1.24 |

| 19 | Turkey | 10.04 | 14.48 | 1.28 | 0.24 | 13.31 | 1.23 |

| 20 | Belgium | 10.82 | 27.07 | 1.38 | 0.23 | 93.35 | 1.22 |

Europe, North America and Asia are the main export destinations of Chinese electric two-wheelers. From January to May this year, the top five export destinations were the United States, the Netherlands, Germany, South Korea and Canada. Among them, the export to the United States totaled USD383 million, up 235.79% year-on-year, with an export volume of 2.3234 million units, up 280.22% year-on-year. The export to the Netherlands reached USD186 million, up 170.65% year-on-year, with an export volume of 537,500 units, up 154.69% year-on-year. The export to Germany totaled USD103 million, up 58.37% year-on-year, with an export volume of 281,300 units, up 53.72% year-on-year.

Strong demand in overseas markets will bring a 10 million-level incremental space for the production of electric two-wheelers in China. Electric two-wheeled vehicles will also become a huge industry reaching a 100 billion scale. With the “Belt and Road” initiative going global, they will benefit billions of people.

According to the data released by China Bicycle Association, in 2020, among the main products of Chinese bicycle manufacturing industry, the output of two-wheeled bicycles reached 44.368 million, with a year-on-year growth of 24.3%; the output of electric bicycles reached 29.661 million, up 29.7% year-on-year.

From January to February 2021, among the main products of the bicycle manufacturing industry, the output of two-wheeled bicycles reached 6.252 million units, up 101.5% year-on-year; the output of electric bicycles reached 3.185 million units, up 81.7% year-on-year.

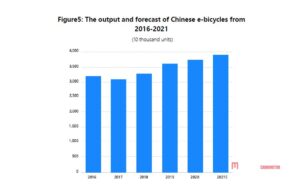

The production and sales of electric bicycles showed a rapid growth trend. It is expected that China’s annual production of electric two-wheeled vehicles will remain above 40 million in the next decade.

The electric two-wheeler market is also full of capital dynamism. According to relevant reports, the share price of the industry leader YADEA has risen 901% within a year, the share price of NIU has also risen fourfold since the beginning of 2020, and AIMA had its IPO application approved in May 2021. In addition, some bike-sharing brands, such as Hellobike, Didi Bike (Qingju) and Meituan, entered the market. Electric two-wheelers may become a new fashion of mobility.

The industry has experienced “boom”, “sluggishness” and “recovery” in 30 years

As a large-scale transportation manufacturing in China, the output of electric two-wheelers in China has maintained at about 25 to 35 million units since 2010. According to EBWR, China is the largest demand market for electric two-wheelers in 2019, accounting for more than 90% of global sales.

Relevant big data show that there are more than 730,000 electric two-wheeler enterprises in China, 73% of which are in the wholesale and retail sectors. In terms of geographical distribution, Jiangsu has the largest number of electric two-wheeler enterprises (more than 85,000), accounting for more than 12%; among them, more than 8,000 enterprises are in Wuxi, including the well-known YADEA and SUNRA. Shandong ranks second with nearly 80,000 enterprises. Hebei and Henan each have more than 50,000 enterprises.

The development of China’s electric two-wheeler industry in the past two decades, according to the time of policy introduction, the production of electric two-wheelers and the increase of enterprises, can be roughly divided into three stages:

At the beginning of the 21st century, the motorcycle market shrank and the electric two-wheeler industry took off. In addition, since the 1980s, China’s urbanization rate began to improve rapidly, and the demand for two-wheelers as a means of transportation continued to grow due to their advantages of economical efficiency and portability. During the ten years from 2001 to 2010, the number of electric two-wheeler enterprises in China grew rapidly, with a total of more than 240,000 new enterprises added, 17 times the 10-year increase of 1991 to 2000, with an annual average registration growth rate of 33%. Among them, 2003 is the year of the fastest growth of electric two-wheeler enterprises, with an annual registration growth rate of more than 51%.

After 2010, with the acceleration of urbanization, China’s urban rail transit developed at a fast pace. The increasingly complete urban rail transit dispersed the demand of electric two-wheelers, and the growth rate of electric two-wheeler enterprises also slowed gradually. In 2010, the annual registration growth rate in China dropped to less than 20% for the first time. In the following eight years, China had an average of 70,000 new electric two-wheeler enterprises every year, and the annual registration growth rate was basically stable at about 15%.

The new round of recovery of China’s electric bicycle production began on May 15, 2018 — the release of the new state standard Safety Specifications for Electric Bicycles (GB17761-2018). It is expected that the new standard will drive a replacement demand of 51 million vehicles in five years. Moreover, the demand for electric two-wheelers will continue to grow in tandem with the development of e-bike sharing and the delivery industry.

In recent years, although the annual registration growth rate of electric two-wheeler enterprises is still not high, the annual increment has been maintained at a considerable number. Big data show that China has more than 100,000 new electric two-wheeler enterprises for three consecutive years.

New trends, battery technology and power swapping services drive industry innovation

According to public information, there are two types of electric two-wheeler batteries: lead-acid batteries and lithium batteries. At present, China has more than 36,000 lithium battery and more than 3,000 lead-acid battery enterprises. The year of 2018 saw the largest number of new entrants (more than 8,100 lithium-ion battery and 610 new lead-acid battery enterprises).

Lithium-ion batteries have incomparable advantages in terms of light weight, long cruising range and life. Since the introduction of new state standard in 2018, the annual registration growth rate of lithium battery enterprise has always been higher than that of lead acid battery enterprises. In 2020, more than 50% of new electric bikes released by major brands are equipped with lithium batteries.

In the next few years, with the expansion of the domestic sharing market, the gradual improvement of industrial standardization, and the accelerated replacement of lead-acid batteries by lithium batteries, it is expected that by 2025, the shipment of lithium batteries for light electric two-wheelers in China will reach 35GWh, and the penetration rate of lithium batteries in new electric two-wheeled vehicles will exceed 80%, and the penetration rate in the stock market will be close to 50%.